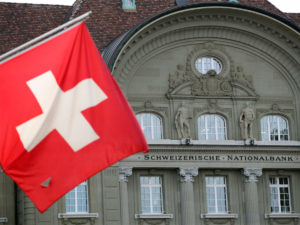

Are you looking to protect your assets but don’t trust your local banking regulations? Would you prefer something more secure and offers better investment opportunities? According to most wealthy investors, one of the most powerful tools of success is opening a bank account offshore. There are so many benefits that come with having an account in a jurisdiction outside of your home country. Switzerland has one of the best banking jurisdictions for global investors and has some of the most favorable banking regulations. Keep reading to find out how an offshore bank account in Switzerland can benefit your life and how to open an account with the help of Primo Asset Management.

WHY OPEN A SWISS BANK ACCOUNT

With one of the highest GDPs in Western Europe, Switzerland is one of the wealthiest countries in the region. There is no national deficit, which demonstrates the strength of this nations’ economy. The income in Switzerland exceeds the costs, so the currency is entirely backed by a self-reliant economy. Unemployment rates are low, and income is high per capita. Swiss citizens are happy with their economy, and wealthy investors often move here to take advantage of the economic security. However, offshore banking is not just for those who do not live in a country with untrustworthy economies. Individuals from first-class nations still hold a Swiss bank account to a higher degree than others. A safe, strong economy is often the first thing an investor will look for when deciding on their offshore banking destination.

Another important factor when looking at offshore banking destinations is confidentiality. Not unlike the expectations of doctor-patient confidentiality, Swiss banking laws forbid bankers to disclose information regarding an individual’s account. They aren’t even allowed to disclose that a person even holds a bank account or any other information about it without the direct consent of the account holder. If a bank does give out personal information without the account holder’s permission, laws require that immediate prosecution begins.

HOW TO OPEN A BANK ACCOUNT IN SWITZERLAND

If you prepare correctly, opening a Swiss bank account can be easy. The process will take time, however. Along with a minimum deposit, which is typically at least $100,000, hopeful applicants will be asked to provide a valid passport along with various documentation regarding their financial history and income, and documents proving that all supplied information is valid. Below, we lay out some of the steps for opening of a Swiss bank account.

- Determine your eligibility

Swiss banks will do their due diligence to make sure non-resident accounts are not being utilised to take advantage of the system for the use of illegal activities. The bank you choose will need thorough verification to make sure you are eligible to hold an account offshore. In some cases, a bank may reject an individual for being a politically exposed person or someone who has been involved in a scandal or is well known for having a negative reputation. Additionally, some countries, such as Russia and Iraq, are barred from opening a Swiss bank account for various reasons, such as official embargoes.

- Pick your bank

There are many notable Swiss banks to choose from. As a global investor with a range of needs, you will want to pick a bank that has the services that are best for you. To choose a bank, you will need to educate yourself on the bank’s policies, investment opportunities, and reputation. Primo Asset Management has relationships with some of the most well-respected banks in Switzerland. For more information on our partnerships, contact our experts below.

- Choose the type of account that fits your needs.

This will come along with choosing the bank that offers the services you need. It is important to create a list of financial goals you want to accomplish with your new bank account. Use your list of needs to determine the kind of account you will open. There are several different kinds of accounts an individual can open. Every type of account requires an initial deposit and may have other qualifying factors.

- Get in touch with the Swiss banks.

Unfortunately, opening a Swiss bank account is not as simple as clicking some buttons online. Individuals seeking to open an account will need to meet a bank representative. If the applicant can not physically appear at a branch or representative office, they may communicate with a representative via mail and request an application package.

- Gather your documents

As we stated earlier, opening a Swiss bank account will require certain documentation that will validate your identity and your intentions with the potential account. This typically includes a copy of your passport that is certified by an approved institution. The bank may potentially ask for documentation regarding the source of the funds expected to enter the account. Swiss banks will not accept funds that they know are suspect of may have been obtained through illegal activities. For example, they could ask for bank statements showing salary payments or documents from the sale of a property or asset.